Table of Contents

The introduction of Value Added Tax (VAT) in the UAE in 2018 marked a significant shift, as the country had never previously applied a federal tax on goods and services. This led to understandable confusion among businesses and residents about how VAT works and what compliance involves. Since then, one of the most common queries has been about the Tax Registration Number (TRN), what it is, how to obtain it, and how TRN verification in Dubai or the UAE works for checking a business’s VAT status.

A TRN is issued once a business successfully completes VAT registration with the Federal Tax Authority (FTA). After approval, the FTA assigns the TRN, which is required for VAT invoicing, return filings, and official documentation. It also enables TRN verification in the UAE through the FTA’s system, allowing businesses and individuals to confirm a company’s VAT registration status.

What is TRN in the UAE?

A Tax Registration Number (TRN) in the UAE is a unique identification number issued by the Federal Tax Authority (FTA) to businesses and individuals after successful VAT registration. Introduced alongside VAT in 2018, the TRN became a key component of the UAE’s first nationwide tax system. It confirms that a business or individual is officially registered with the FTA and authorised to charge, collect, and remit VAT.

Once VAT registration is approved, the TRN is automatically generated through the FTA portal and is mandatory for issuing VAT-compliant invoices, filing returns, and dealing with tax authorities. The TRN also supports transparency, as clients, suppliers, and regulators can conduct TRN verification in Dubai or across the UAE to confirm a business’s VAT registration status and ensure compliance with tax regulations.

What is the TRN Format in the UAE?

The Tax Registration Number (TRN) format in the UAE follows a standard structure set by the Federal Tax Authority (FTA) to uniquely identify every VAT-registered business or individual.

A UAE TRN is a 15-digit numeric code, with no letters, symbols, or spaces.

UAE TRN Format Example

TRN: 123456789012345

Key Points About the TRN Format

- Always 15 digits long

- Numeric only (no alphabets or special characters)

- Issued only after successful VAT registration

- Unique to each VAT-registered entity

- Remains the same unless the VAT registration is cancelled or amended by the FTA

Where Is the TRN Used?

The TRN must be clearly mentioned on:

- VAT tax invoices

- Credit notes and debit notes

- VAT returns filed with the FTA

- Official tax-related communications

Why the Correct TRN Format Matters?

Using the correct TRN format ensures:

- Valid VAT invoices

- Smooth VAT return filing

- Easy TRN verification in the UAE via the FTA portal

- Accurate TRN verification in Dubai for customers and suppliers

Any error in the TRN format can lead to invoice rejection, compliance issues, or penalties under UAE VAT law.

The UAE TRN format is simple but critical, a 15-digit number that confirms your VAT registration and legal tax status in the UAE

Penalties & Risks of Using Invalid TRNs in the UAE

Below are the penalties and risks of using invalid TRNs in the UAE:

| Penalty / Risk | What It Means | Penalty Amount / Impact |

|---|---|---|

| Using an Incorrect or Invalid TRN | Mentioning a wrong, fake, or inactive TRN on tax invoices or documents. | AED 5,000 per incorrect TRN |

| VAT Non-Compliance | Charging or reclaiming VAT without a valid TRN. | AED 10,000 for first offence, AED 50,000 for repeat offences |

| Input VAT Claim Rejection | Claiming VAT using invoices with invalid TRNs. | Input VAT denied, resulting in direct financial loss |

| Submission of Incorrect VAT Details | Providing inaccurate VAT or TRN-related information to the FTA. | AED 3,000–5,000 per incorrect submission |

| Tax Evasion (Intentional Misuse) | Deliberate use of fake or misleading TRNs to evade VAT. | Up to 5 times the VAT amount involved, plus legal action |

| Legal & Regulatory Action | Serious or repeated VAT violations linked to invalid TRNs. | Business suspension, licence risk, or prosecution |

| Bank & Audit Issues | Banks and auditors are rejecting documents with invalid TRNs. | Account freezes, audit failures, delayed approvals |

| Business Reputation Damage | Clients verify TRN through TRN verification in Dubai / UAE. | Loss of contracts, delayed payments, and credibility damage |

Important Note

Penalty amounts are based on FTA administrative penalty guidelines and may vary depending on:

- Nature of the violation

- Whether it’s a first or a repeat offence

- Intent (error vs. deliberate misuse)

What is TRN’s Significance?

TRN registration is a productive, time-efficient, and cost-saving process for both the public and private sectors. It can assist with:

- Reclaiming previously paid taxes on the purchase, production, and processing of a product or merchandise.

- Offering a refund to businesses that have registered for VAT and acquired a valid TRN.

- Recoupment of business purchases through VAT by the purchaser.

- Tax registration number strengthens the credibility and profile of the Company.

According to the UAE’s VAT Law, TRN Verification of all tax documents is required for businesses, including the following:

- Tax Invoice

- VAT Return Tax

- Credit notes

- Other relevant tax documents

Who Needs to Register for a TRN in the UAE?

Businesses in the UAE must assess their turnover to determine whether they are required to register for VAT and obtain a TRN. The Federal Tax Authority (FTA) has set clear thresholds to guide this process and ensure smooth TRN verification with the FTA, especially for businesses operating in Dubai and across the UAE.

Mandatory VAT Registration

VAT registration becomes compulsory once a business’s taxable supplies and imports cross AED 375,000.

If your company’s revenue or taxable imports exceeded AED 375,000 in the past 12 months or are expected to cross this limit within the next 30 days, you must register for VAT and complete TRN verification to stay compliant and avoid fines.

It’s important to note that this threshold does not apply to foreign businesses, which may be required to register regardless of turnover, depending on their taxable activities in the UAE.

Voluntary VAT Registration

Businesses with taxable turnover between AED 187,500 and AED 375,000 have the option to register voluntarily.

Voluntary registration allows businesses to obtain a TRN and proceed with TRN verification in Dubai, helping them recover input VAT and improve credibility with clients and suppliers, even if registration isn’t legally mandatory yet.

Exempt from VAT Registration

If a company’s annual taxable revenue and imports remain below AED 187,500, VAT registration is not required, and TRN verification with the FTA is not applicable.

Understanding where your business stands help ensure timely TRN verification, avoids compliance issues, and keeps your operations fully aligned with UAE VAT regulations.

How to Verify a TRN in the UAE?

TRN verification is a simple online process that helps you confirm whether a business is VAT-registered with the Federal Tax Authority (FTA). Whether you’re validating a supplier or doing a routine compliance check, TRN verification in the UAE can be done by anyone in just a few minutes.

Here’s how to complete a TRN check smoothly:

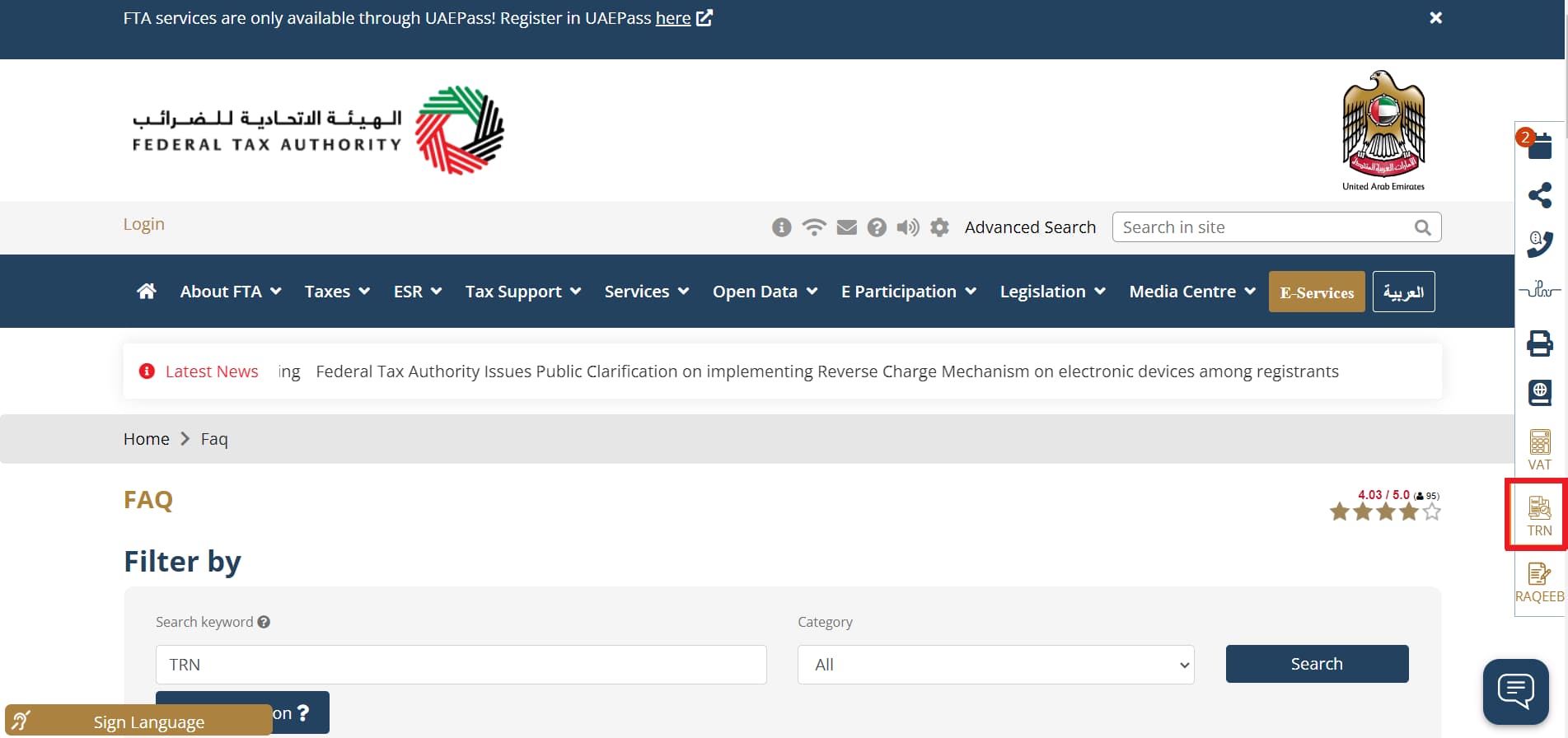

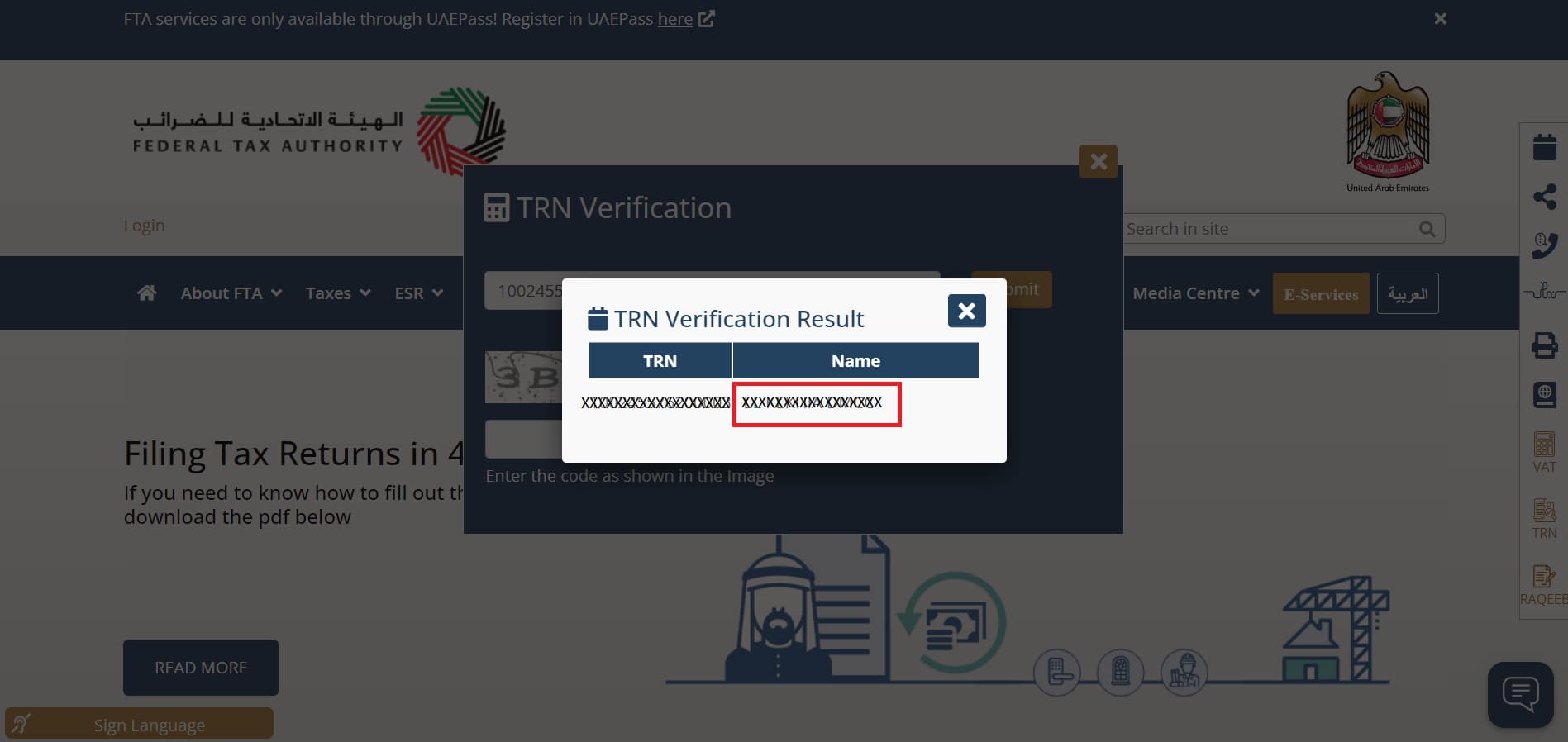

Step 1: Access the FTA Portal

Visit the official Federal Tax Authority website. On the homepage, locate and select the “TRN” option from the side panel.

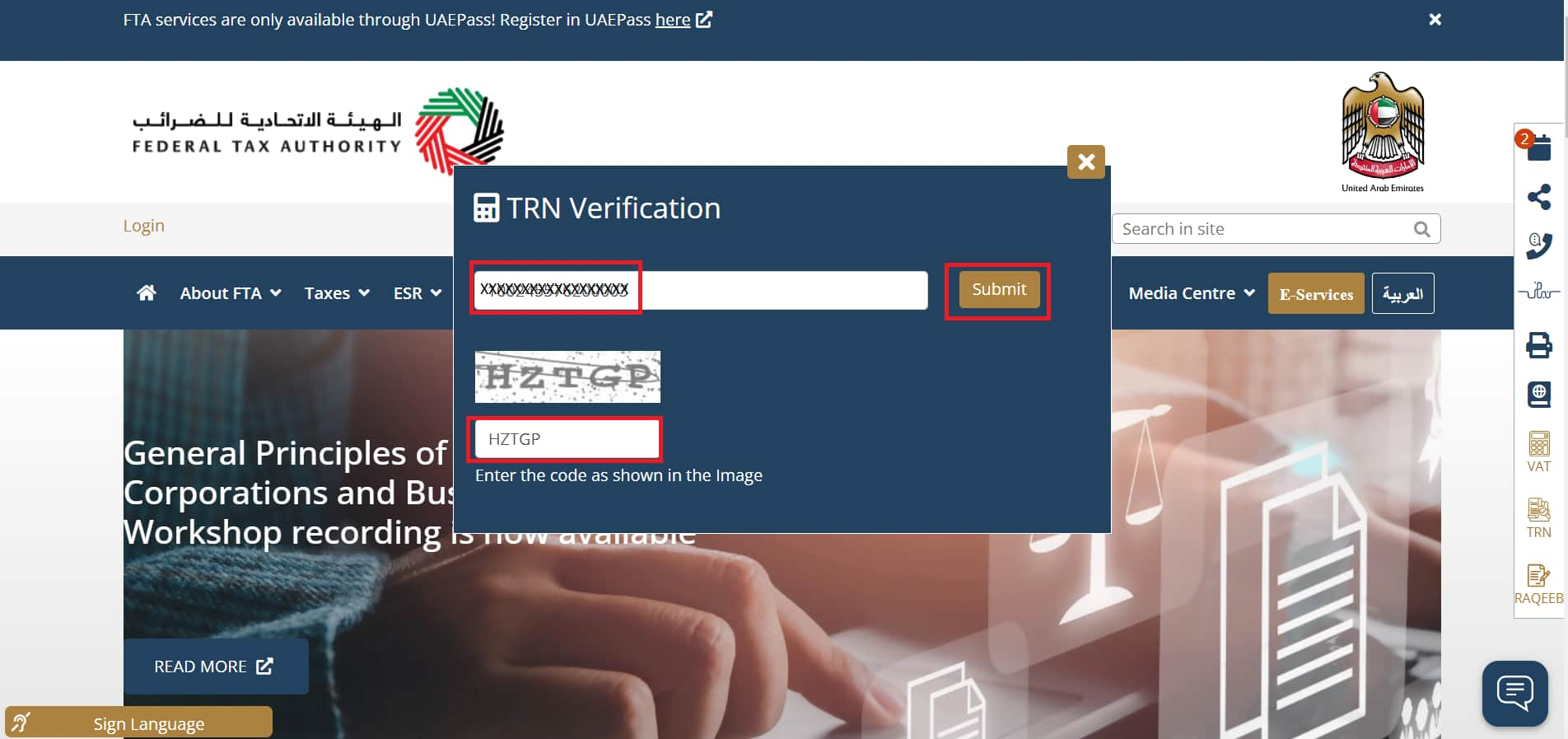

Step 2: Enter TRN Details

Input the Tax Registration Number in the required field, complete the captcha for security verification, and click Search.

Step 3: Confirm Business Information

The system will display the registered business name associated with the TRN. Match these details with your records to ensure accuracy.

This process applies nationwide and is commonly used for TRN verification in Dubai and other emirates. Regular TRN verification helps businesses avoid errors, ensure VAT compliance, and maintain transparent transactions.

What Is the Purpose of a TRN and VAT in the UAE?

After a business successfully completes VAT registration, the Federal Tax Authority (FTA) issues a Tax Registration Number (TRN) along with an official TRN certificate. This certificate authorises the company to file VAT returns within the timelines set by the FTA and confirms its legal status as a VAT-registered entity.

Holding a valid TRN allows a business to:

- Build trust with large corporations and government entities, as many prefer working only with TRN-registered vendors

- Strengthen its banking profile when opening or maintaining corporate bank accounts

- Officially represent the company before foreign authorities, partners, and international institutions

How can Shuraa Tax support you?

To avoid penalties, you can employ a reputable consulting firm that can provide end-to-end solutions for TRN registration, from assessment to procurement.

For a better grasp of the TRN requirements, Shuraa Tax can assist your business in navigating the extensive guidelines of the UAE’s new tax law. With our assistance, you can establish a tax structure for your business that will save you time, mitigate risks, and safeguard your assets.

📞 Call: +(971) 44081900

💬 WhatsApp: +(971) 508912062

📧 Email: info@shuraatax.com