Table of Contents

- VAT Certification in UAE

- Facts About Value Added Tax (VAT) in Dubai

- Benefits of VAT Certificate in UAE

- How to get a VAT Certificate via EmaraTax

- How to Download VAT Return in EmaraTax?

- How do you get a VAT Registration Certificate for newly registered taxpayers?

- How do you download a VAT registration certificate for previous taxpayers?

- How to Register for VAT in UAE

- Required Documents and Forms for VAT Registration in UA

- Shuraa Tax in UAE

- FAQs

In the UAE, businesses exceeding an annual turnover of AED 375,000 must register for VAT. Upon registration, these companies must levy VAT on taxable goods and services provided to customers, alongside submitting regular VAT returns to the FTA. The VAT certificate in UAE adherence to UAE VAT laws and regulations.

Are you prepared to obtain your VAT certificate in the UAE? Knowing the correct procedure is essential for businesses operating in the region. At Shuraa Tax, we’ve streamlined the process to make sure you can effortlessly download your VAT certificate in the UAE. Let’s explore further!

VAT Certification in UAE

Opting for a VAT certification in Dubai is not mandatory, but it offers significant advantages to businesses by providing comprehensive transaction details. The certification process involves completing a VAT training course offered by various agencies. This training covers essential operational aspects such as purchasing, selling, importing, exporting, and understanding input and output VAT.

Due to its high demand, getting this certificate typically takes 2-3 weeks. Once acquired, the UAE VAT certificate equips businesses with the necessary information and skills to manage VAT compliance challenges effectively.

The VAT Certificate in UAE includes:

- Applicant details

- Estimated registration date

- First VAT return deadline

- Dates marking the beginning and end of the tax period

Facts About Value Added Tax (VAT) in Dubai

Here are some essential details about VAT in the UAE:

- VAT is applied at a rate of 5% across the UAE.

- The FTA imposes a 0% tax rate on specific goods and services.

- Companies with annual expenditures exceeding AED 187,500 can opt for VAT registration.

- Businesses earning over AED 375,000 annually are required to register for VAT with the Federal Tax Authority (FTA).

- Registered sellers with the FTA are eligible for tax credits or reimbursements on VAT paid during purchases.

Benefits of VAT Certificate in UAE

The VAT certificate in Dubai is highly sought as compared to others. It offers significant advantages:

- Possession of a VAT certificate demonstrates a commitment to VAT compliance, aiding in building trust with clients seeking reliable business partners.

- The rigorous training required to get the VAT certificate equips individuals with detailed knowledge of calculations, bookkeeping, and filing returns. This knowledge minimises errors and improves productivity.

- Holding a VAT certificate provides different advantages, such as reducing the risk of FTA penalties and developing better decision-making skills for business growth.

How to get a VAT Certificate via EmaraTax

EmaraTax, the UAE’s new digital tax platform, streamlines obtaining your VAT Registration Certificate. Here’s how:

Existing FTA account users have their tax certificates automatically transferred from e-services upon migrating to EmaraTax.

New taxpayers can follow these steps:

1. Log in to EmaraTax using your Emirates ID, UAE Pass, or taxpayer account credentials.

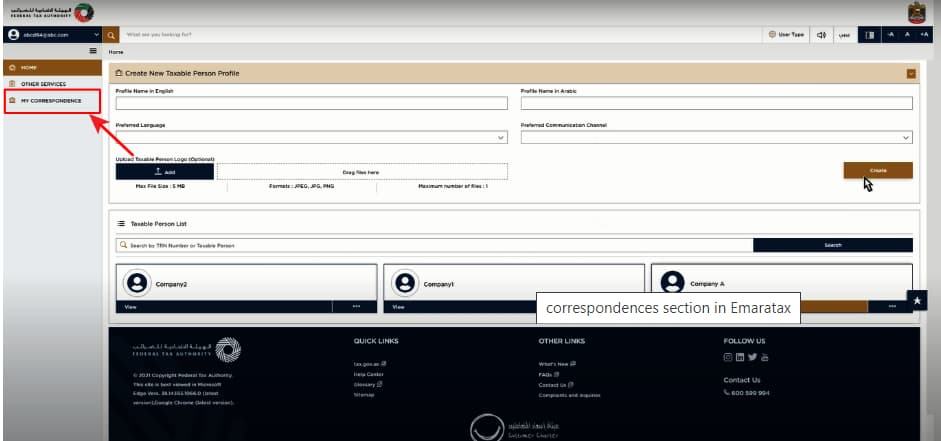

2. Navigate to the dashboard and locate the VAT registration certificate in the “My Correspondences” section of your Taxable Person account.

3. Click on the certificate and download it in PDF format.

For detailed guidance, watch this video: [VAT Registration on EmaraTax https://www.youtube.com/watch?v=bvb3AQLFXv4.

Note: If your tax registration certificate wasn’t previously accessible in PDF format on the system, it won’t appear on your EmaraTax dashboard.

How to Download VAT Return in EmaraTax?

The FTA allows you to download an acknowledgement exclusively for submitted returns in EmaraTax. Here’s how to download a VAT certificate in UAE:

1. Log in to EmaraTax.

2. Submit your VAT Returns, ensuring all required documents are included.

3. Complete the payment process.

4. After submitting your VAT return, find the acknowledgement screen.

5. Click to download the acknowledgement screen.

Additionally, the FTA will send an email to confirm the submission of your refund in EmaraTax.

How do you get a VAT Registration Certificate for newly registered taxpayers?

After registering for VAT in EmaraTax, you can view the payment in your Transaction History and download the receipt. Follow these steps to obtain a hard copy of the VAT Certificate:

- File an application: Apply form through the FTA VAT Certificate service.

- Receive Request Number: The FTA will provide you with a Request Number, which you’ll use to pay the fees on the EmaraTax portal.

- Pay the Service Fee: The FTA service fee for a VAT Certificate is AED 250. Pay this fee through the EmaraTax portal using an E-Dirham or debit/credit card. Obtain a payment reference number.

- Payment Confirmation: After you make the payment, you’ll receive a confirmation email. The FTA will print and mail your VAT Certificate to your registered company address.

Alternatively, you can get the VAT Certificate service from Dubai Customs for AED 100 plus additional charges.

How do you download a VAT registration certificate for previous taxpayers?

Below are the points which will help you download the VAT registration certificate for the previous taxpayers:

- Access the EmaraTax platform using your Emirates ID, UAE Pass, or taxpayer account credentials.

- In the dashboard, find your VAT registration certificate under “My Correspondences” in your Taxable Person account.

- Click on the certificate and download it as a PDF.

Note: If you are a previous user and your tax registration certificate was unavailable as a PDF document in your old account’s dashboard, you cannot find it in your EmaraTax dashboard.

How to Register for VAT in UAE

VAT registration is optional for businesses in the UAE. However, businesses must register for VAT if their taxable supplies and imports exceed AED 375,000. Additionally, businesses can voluntarily register for VAT if their taxable supplies and imports surpass AED 187,500.

According to the UAE Federal Tax Authority (FTA), taxable supplies are defined as:

“Goods or services provided by a business in the UAE, taxable at either 5% or 0%, including imports under similar taxable conditions.”

Businesses gather VAT from customers and remit it to the government. VAT-registered businesses can also reclaim any VAT paid to their suppliers from the government.

Required Documents and Forms for VAT Registration in UA

When applying for VAT registration in the UAE, make sure you compile the following information in the appropriate format for your online application:

- Valid trade license(s)

- Passport/Emirates ID of the authorised signatory(s)

- Proof of authorisation for the authorised signatory(s)

- Contact information

- A bank letter confirming the applicant’s bank account details

Additional documents may be required based on the nature of your registration:

For Taxable Supplies (excluding Federal and Emirate Government)

- Audit report (audited or non-audited financial statement)

- Self-prepared calculation sheet detailing taxable/zero-rated supplies based on financial records

- Projected revenue with supporting documents such as a Local Purchase Order or Contract

- Monthly turnover declaration for specified periods, signed and stamped by the authorised signatory on the entity’s printed letterhead

- Supporting financial documents (e.g., invoices, LPOs, contracts, title deeds, tenancy contracts)

For Taxable Expenses (excluding Federal and Emirate Government)

- Audit report (audited or non-audited financial statement)

- Expense budget report

Additional Documents

- Articles of Association/Partnership Agreement (if applicable)

- Certificate of Incorporation (if applicable for Legal Person)

- Documents showing ownership information of the business

- Customs details (if applicable)

- Power of Attorney documents (if applicable)

- Club, charity, or association registration documents and supporting evidence (if applicable for “Legal person – Club, Charity, or Association”)

- Copy of the Decree (if applicable for “Legal person – Federal UAE Government Entity” or “Legal person – Emirate UAE Government Entity”)

- Other relevant documents providing information about your organisation, its activities, and size (if applicable for “Legal person – Other”)

- Scanned copies of the Emirates ID and passport for the manager, owner, and senior management

- Scanned copy of the land/property title deed (if applicable for “Legal Person – Incorporate/Legal Person – Club or Association/Legal Person – Charity/Legal Person – Federal UAE Government Entity/Legal person – Emirate UAE Government Entity/Natural Person”)

Read more: Tax Residency Certificate in UAE

Shuraa Tax in UAE

Shuraa Tax sets the standard for VAT registration services in the UAE, utilising FTA FTA-registered tax agents with direct access to EmaraTax. Our expert team is well-versed in guiding clients through VAT registration and obtaining VAT Certificates via the EmaraTax portal.

Do you need assistance downloading your VAT Certificate from EmaraTax? Shuraa Tax Dubai is here to help! Call +971 50 891 2062 or email info@shuraatax.com today.

FAQs

Q1. What are the Consequences of Operating Without VAT Certification in Dubai?

Operating without VAT certification in Dubai can lead to severe penalties, including hefty fines, suspension of services, and even business closure. It also risks damaging your reputation and losing customer trust.

Q2. How to Get VAT Certified in Dubai?

To get a VAT certification in Dubai, businesses need to:

1. Register for VAT with the FTA.

2. Ensure compliance with VAT regulations.

3. Maintain accurate financial records.

4. Undergo periodic audits.

Q3. Who Needs VAT Certification in Dubai?

Any business operating in Dubai or the UAE that meets the mandatory VAT registration threshold must obtain VAT certification to legally conduct taxable activities and comply with tax regulations.