Table of Contents

- What is VAT?

- How to Claim a VAT Refund in UAE for Tourists?

- Eligibility Criteria for VAT Refund

- How to Request a VAT Refund in Dubai, UAE

- Documents Required for Claiming VAT Refund in UAE

- Steps to Update the Bank Details in VAT Refund Request

- VAT Refunds for Non-Tax Residents in the UAE

- Process of VAT Refund for Non-Tax Residents in the UAE

- What is the Refund Period?

- Collecting Your VAT Refund in UAE

- Terms and Conditions for VAT Refund

- Goods For Which VAT is Not Refundable Include:

- VAT Refund Point Locations in the UAE

- VAT Refund Services in UAE with Shuraa Tax

- Frequently Aksed Questions

You can reclaim 85% of the VAT you paid through the VAT Refund in Dubai and the UAE. Importantly, this process does not incur the AED 4.80 fee per Tax-Free Dubai Tag. Furthermore, the VAT Refund Procedure automatically calculates the total refund amount, which helps ease the process for travellers and businesses. Overall, this scheme is designed to make it easier for visitors and residents to recover a significant portion of their expenses.

Moreover, understanding the intricacies of this procedure can maximise your refund potential and ensure compliance with UAE regulations. In this blog, Shuraa Tax will provide a comprehensive guide to claiming your VAT refund in the UAE for 2026.

From the eligibility criteria and documentation requirements to the step-by-step process of filing your claim. Stay informed and fully utilise the VAT Refund Scheme to recover your expenses effectively.

What is VAT?

Dubai VAT (Value Added Tax) is a 5% consumption tax introduced in the UAE on January 1, 2018, and is applied to most goods and services at every stage of production or distribution as part of the country’s move to diversify revenue beyond oil.

While many items fall under the standard rate, some, like exports and international transportation, are zero-rated, and others, including certain financial services and residential properties, are exempt. Businesses must register for VAT if their taxable supplies and imports exceed AED 375,000 annually, with voluntary registration available from AED 187,500, making VAT a key component of building a more sustainable and stable economic model for the UAE.

How to Claim a VAT Refund in UAE for Tourists?

Tourists can claim a VAT Refund in UAE through a system developed by the Federal Tax Authority (FTA) in collaboration with global operator Planet. The Planet VAT Refund system is fully automated, allowing tourists to get their VAT refunds quickly. To use this service, tourists must shop at one of the 13,800.

It can also participate in retailers and request a Tax-Free tag when purchasing. This electronic system connects various entry and exits points across the UAE. It includes 13 airports, land borders, and seaports.

When departing from the UAE, tourists can visit a refund kiosk at the airport, border, or port and present their purchases for a refund. This will help them receive their VAT refund. This efficient process ensures that tourists can quickly recover the VAT they paid on their purchases.

Related Insights: VAT Refund Dubai for Tourists

Eligibility Criteria for VAT Refund

If you’re visiting the UAE and planning to claim a VAT refund before you fly out, here’s what actually makes you eligible. These are the rules tourists must meet:

1. You Must Be a Visitor, not a Resident

Only genuine tourists can claim a refund.

- If you don’t live in the UAE, you’re good to go.

- GCC nationals can also claim a refund, provided they are not UAE residents.

- UAE nationals who live abroad for studies may not always qualify; it depends on their residency status.

2. You Must Be 18 or Older

The VAT refund system is meant for adult travellers. Anyone below 18 or anyone working as crew on flights or ships leaving the UAE cannot apply.

3. The Shop Must Be Registered in the Tourist Refund System

Not every store in the UAE offers VAT refunds. Your purchases must be from a retailer that officially participates in the Tax Refund for Tourists Scheme. Look for the sign at the store or ask before you buy it.

4. Minimum Spend Rule: AED 250

To submit a VAT refund claim, your total bill must be AED 250 or more from participating retailers.

5. Items Must Leave the UAE With You

You can’t claim a refund on products you already used in the UAE.

This means:

- The goods must be unused.

- They must be with you at the airport when you depart.

- Some items are never eligible, including vehicles, boats, aircraft, services, and anything you’re not physically carrying when leaving.

How to Request a VAT Refund in Dubai, UAE

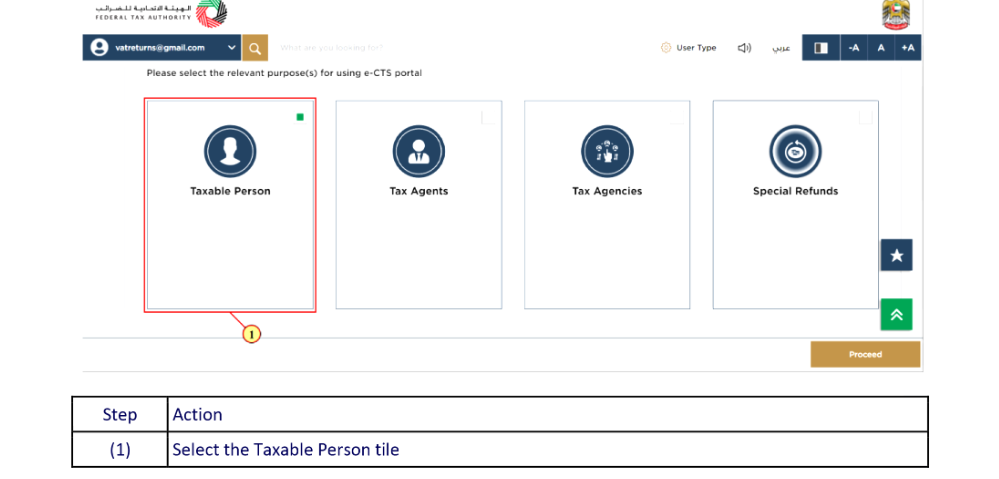

To request and claim a VAT Refund in UAE, log in to the EmaraTax portal and request a VAT Refund form. Fill in the necessary details on the form and submit the required documents. Following these steps will help you request a VAT refund in the UAE:

1: Sign in to EmaraTax

- Access your EmaraTax account using your login credentials or UAE Pass.

- If you do not have an EmaraTax account, click the signup button to create one.

- Upon successful login. You will be directed to your User Dashboard.

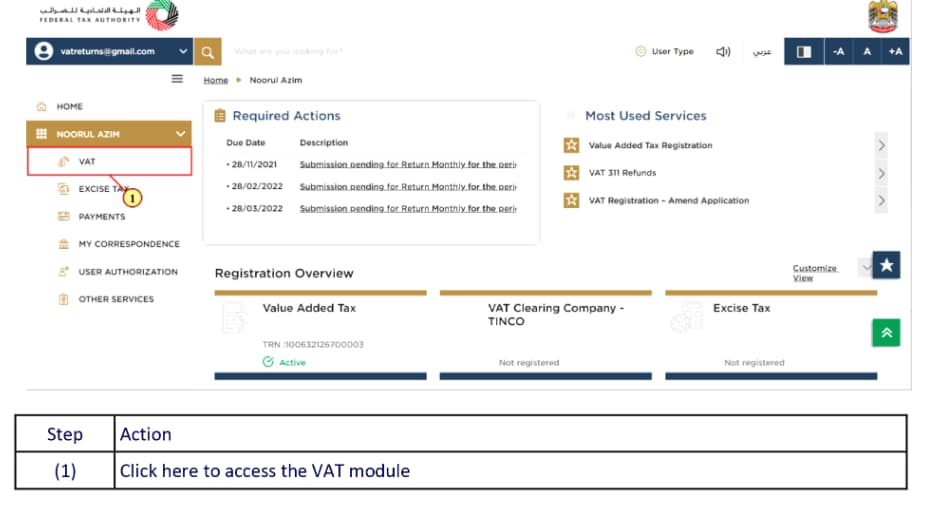

2: Request the VAT Refund form

- Choose the user type as Taxable Person.

- Then click on the proceed button to access the Home page by clicking the View button.

- You can select ‘Tax Agents’, ‘ Tax Agencies’, and ‘Special Refunds’ if applicable.

- Direct to the VAT Module in the left sidebar.

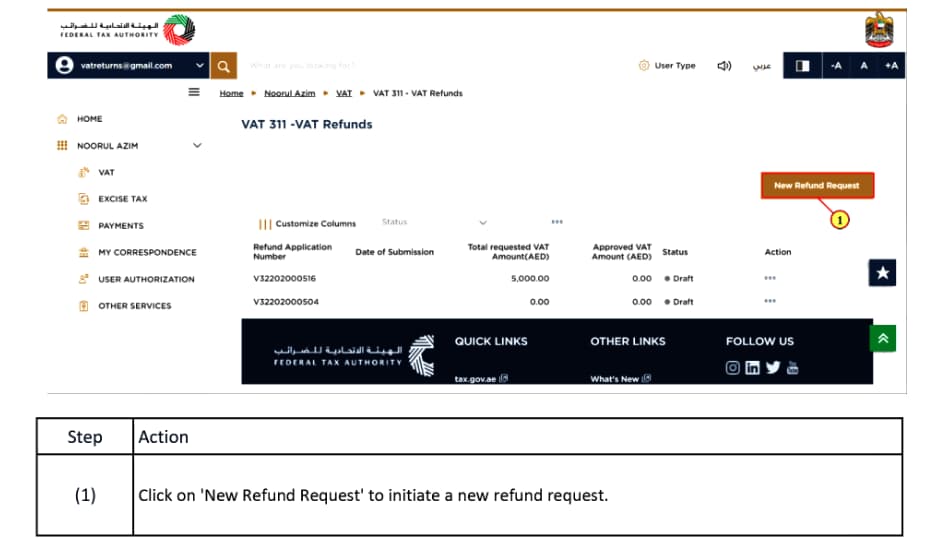

- Click on “New” to create a new VAT Refund Request. You can view your previous VAT 311 refund requests.

- Use the ellipsis icon to edit the Refund request.

- Initiate your refund by clicking the “New Refund Request” button.

- Confirm your understanding of the instructions and guidelines by clicking ‘Next’.

- Initiate the Refund request process by clicking on the Start button.

3: Fill in the necessary VAT Refund in UAE

- Verify your bank details before submitting the form.

- Enter the refund amount, ensuring it does not exceed the “Excess Refundable VAT Amount.”

- Click on ‘Add Supporting Details’ to view the corresponding VAT refund.

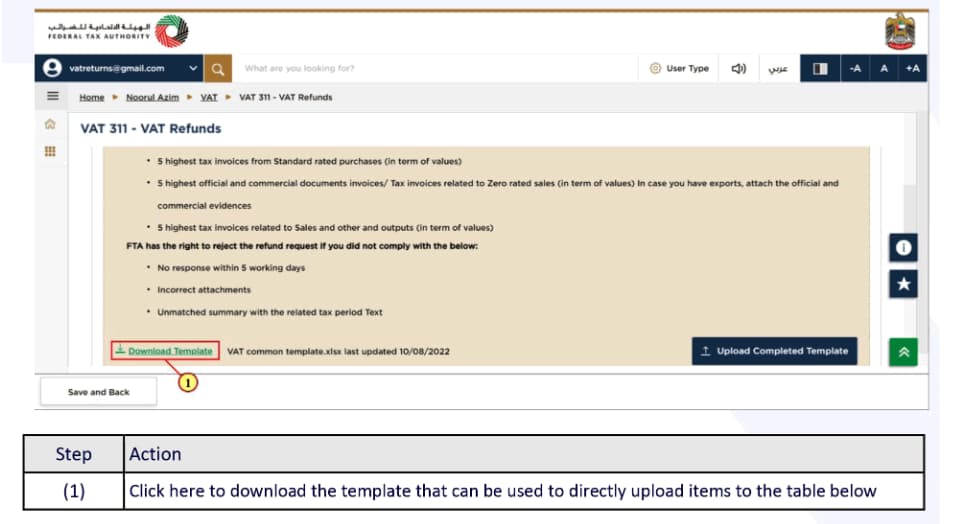

- Tap on the download button to download the template. Fill it out.

- Then upload the completed template.

- Use the edit button to enter contact information and VAT supplies.

- Click on the add button to upload the required document.

- It will turn green upon successful upload.

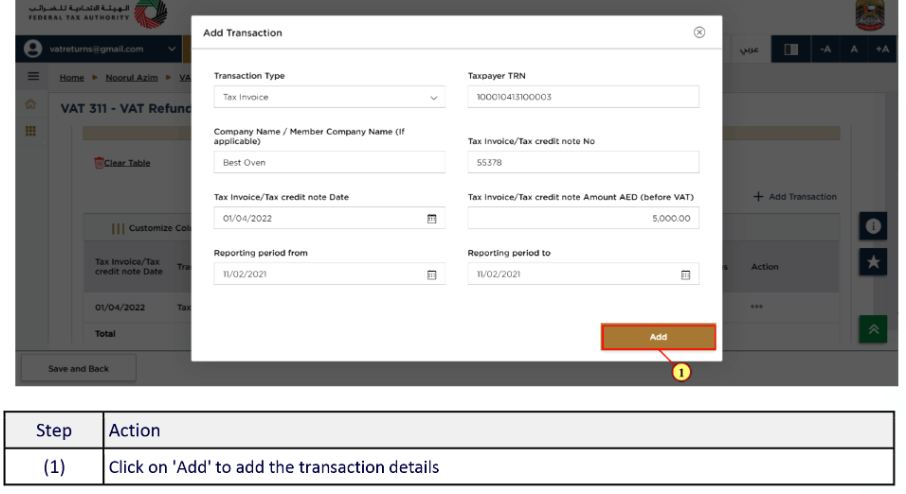

- Click the “Add Transaction” button to input transaction details.

- Then click “Add Transaction” to confirm.

- Use the ‘Save and Back’ button to save your progress.

- Click ‘Next’ to proceed to the completed Refund Request. You can review it before submission.

- Review each section by clicking on the respective step.

After filling out the VAT refund form. Mark the checkbox to confirm your agreement with the terms and conditions before submitting it using the ‘Submit’ button. Make sure to note down the application number provided upon submission for future reference.

Once successfully submitted, you can conveniently access and manage your refund request. This process makes sure that your VAT refund application is processed efficiently and by UAE tax regulations, allowing you to track its progress and manage any further actions as needed.

Documents Required for Claiming VAT Refund in UAE

The documents required for claiming a VAT Refund in UAE include:

- Top five tax invoices for outputs, sales, and other transactions.

- Supporting evidence for excess credit refunds or erroneous payments.

- Top five tax invoices for standard-rated purchases.

- Bank account validation letter (for foreign banks).

- Top five tax invoices for untaxed sales (with export evidence if applicable).

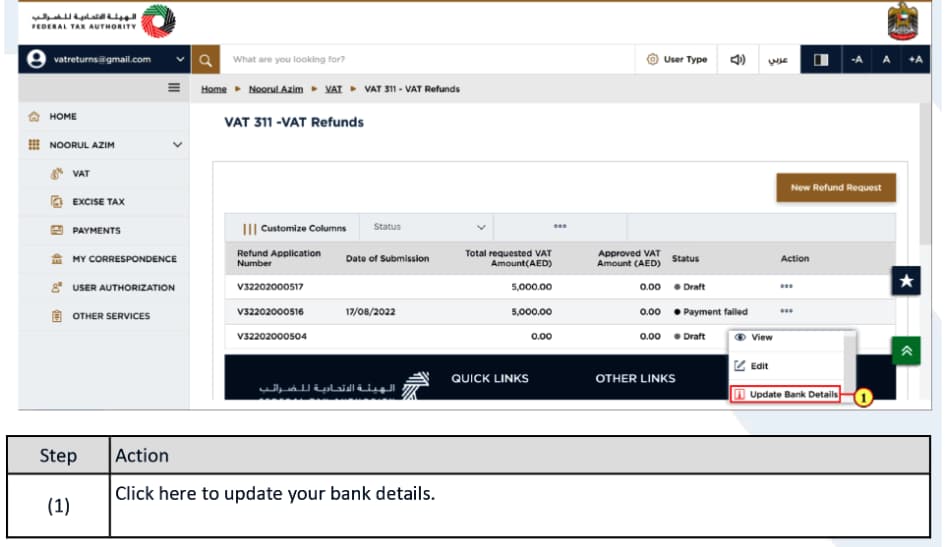

Steps to Update the Bank Details in VAT Refund Request

To update bank details in your VAT refund request:

- Follow the initial steps for applying for a VAT refund on the EmaraTax dashboard up to Step

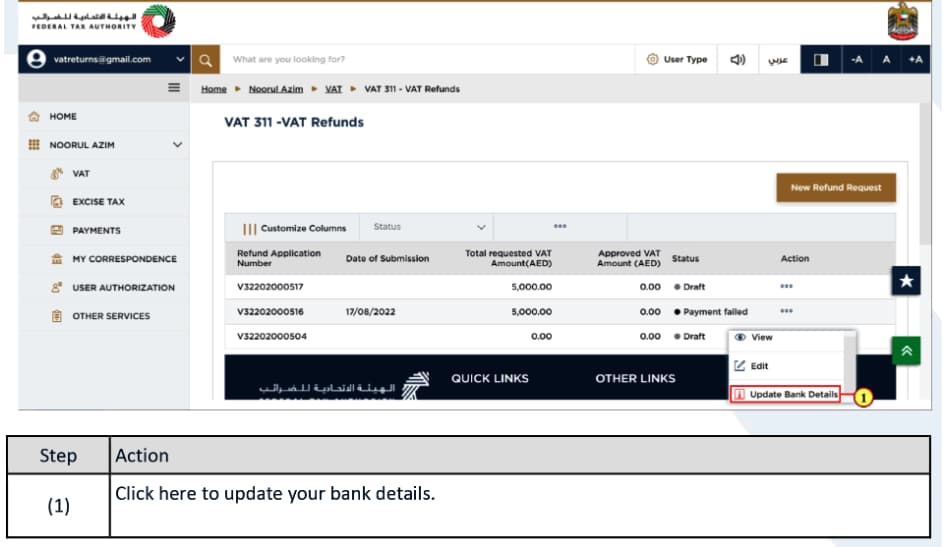

- Identify the application entry marked with the status ‘Payment Failed’.

- Click on the ellipsis (…) and choose the ‘Update Bank Details’ option.

- Select “Enable Editing” to make the bank details section editable.

- Enter all required bank details.

- Upload the necessary document.

- Click the “Next Step” button to proceed.

- Follow the same application steps as when applying for a VAT refund on EmaraTax.

VAT Refunds for Non-Tax Residents in the UAE

VAT refunds for non-tax residents of the UAE are available at Abu Dhabi International Airport. The UAE Federal Tax Authority announced this initiative on November 18, 2018. Current regulations allow GCC nationals and other non-residents of the UAE to benefit from Tax-Free Shopping.

This includes purchasing goods in the UAE for export, subject to specific limits and conditions. Customers who comply with regional regulations and authenticate their purchases may qualify for refunds on eligible goods.

Process of VAT Refund for Non-Tax Residents in the UAE

The process of VAT Refund for Non-Tax Residents in the UAE is as follows:

- Present a valid passport to make a tax-free purchase as a tourist.

- Shop employees record tourist information using the system.

- Affix the Tax-Free sticker to the back of the sales receipt.

- Visitors must authenticate the purchase at the airport, where a Tax-Free digital form has been prepared.

What is the Refund Period?

You must validate your tax-free tag within 90 days from the date of purchase. For example, a form issued on January 1 remains valid until April 1. Kindly validate within this period to avoid the expiration of the Tax-Free tag, which will make you ineligible to claim the VAT refund.

Collecting Your VAT Refund in UAE

To collect your VAT refund in UAE, follow these steps:

- Bring the items and the receipt to the airport with you.

- Visit a validation station where your purchases and receipts will be verified.

- Choose your preferred refund method. You may undergo a secondary validation check and must present your goods for inspection.

- Each traveller can receive a maximum of 10,000 AED in cash for cash refunds. Amounts exceeding this limit must be refunded via credit or debit card.

Terms and Conditions for VAT Refund

To claim a VAT refund:

- You must be at least 18 years old and not a UAE resident.

- You must enter the UAE with a tourist visa.

- Have your tax invoice, tax-free tags, and purchased items ready if requested by Planet staff.

- Validate your tax-free transactions within 90 days of receiving the tax invoice before leaving the UAE.

- Retailers must be registered with the tourist refund scheme.

- You can request a refund within one year of validating your tax-free transactions for export. With a maximum cash refund limit of AED 35,000.

- VAT refunds apply only to items under the Tourist Refund Scheme.

- The minimum purchase amount eligible for a refund is AED 250.

- Ensure purchased items are not consumed fully or partially while in the UAE.

- Perishable items used in the UAE.

- Services.

- Items used within the UAE are not in the original packaging.

- Items not in possession upon departure.

- Motor vehicles, watercraft, and aeroplanes.

- Internet purchases.

Goods For Which VAT is Not Refundable Include:

- Products consumed, either wholly or partially, within the UAE.

- Items such as cars, boats, airplanes, and other goods intended solely for use within the UAE, are left behind by tourists before departing the country.

VAT Refund Point Locations in the UAE

VAT refund points are available at various locations across the UAE when exiting the country, including airports, seaports, and land borders. Visit Planet’s self-service kiosks at the following locations:

Seaports

- Zayed Port, Abu Dhabi

- Port Rashid, Dubai

Airports

- Dubai Airport (Terminals 1, 2, 3, and 3 Business)

- Abu Dhabi Airport (common area between all terminals)

- Al Maktoum Airport

- Ras Al Khaimah Airport

- Sharjah Airport

- Al Ain Airport

Land Borders

- Hatta (border with Oman)

- Al Ain (border with Oman)

- Al Ghuwaifat (border with Saudi Arabia)

VAT Refund Services in UAE with Shuraa Tax

Shuraa Tax is one of the experienced VAT consultants in Dubai. This focuses on providing VAT refund services to businesses and business tourists across the UAE. Our team assists companies in identifying eligible expenses and preparing the required documentation for VAT refund claims.

Claiming a VAT refund can often be intricate and time-consuming, but with our expertise, businesses can be assured of a streamlined and accurate process. Contact us today at +971508912062 or info@shuraatax.com to learn more about how we can help with your VAT refund needs.

Frequently Aksed Questions

Q1. When Should Validation be Done?

You must validate your tax-free tags within 90 days of receiving them. Additionally, you must depart from the UAE within 6 hours of validation. Failure to do so will result in the validation of approval being cancelled, requiring you to restart the process.

Q2. Who Can Validate the Process?

Only the individual whose name appears on the registered passport or GCC national identity card can initiate or complete the validation process. No third party is permitted to do this on their behalf.

Q3. What if I Don’t Receive the Refund in 9 Days?

If you have not received your refund within nine calendar days, it is advisable to contact your card issuer or bank promptly to inquire about its status.

Q4. Which Cards Can Receive Refunds?

Refunds can be credited to Visa, MasterCard, American Express, and UnionPay cards. Refunds are typically processed in the local currency (AED), with the exchange rate determined by your bank or card issuer.

Q5. How to Claim a VAT Refund in the UAE for a Business?

Businesses registered for VAT in the UAE can claim refunds through the FTA (Federal Tax Authority) portal.

Steps:

- Log in to your FTA account (eservices.tax.gov.ae).

- Go to VAT → VAT Refunds → VAT Refund Request.

- Fill out the VAT Refund Form 311.

- Upload supporting documents (VAT returns, tax invoices, audit files if needed).

- Submit the request and wait for FTA approval.

- Once approved, the refund is transferred to your registered bank account.

Q6. How to Claim a VAT Refund in UAE for Tourists?

Tourists can claim VAT refunds on eligible purchases made from retailers participating in the Planet Tax Refund system.

Steps:

- Shop at stores with the “Tax Free Shopping” logo.

- Ask the cashier to generate a Tax-Free Tag using your passport.

- Before departure, go to the Planet kiosk at the airport, border, or port.

- Scan your passport and receipts.

- Choose a refund method: cash or credit/debit card.

- Tourists must export the goods within 90 days of purchase.

Q7. How to Claim VAT Refund in UAE?

VAT refunds depend on whether you are a business, a tourist, or engaged in specific activities (e.g., imports, special cases).

General process:

- Businesses: File refund via FTA portal (Form 311).

- Tourists: Claim via Planet kiosks during departure.

- Special categories (e.g., diplomats, mission offices): Apply through dedicated FTA procedures.

Q8. How to Get a Tax Refund at Dubai Airport?

To claim VAT refund at Dubai Airport as a tourist:

- Keep the purchased goods with you (unused).

- Go to the Planet Tax-Free kiosk before checking in.

- Scan your passport and receipts.

- Present goods for verification if asked.

- Choose a refund via cash or card.

- Cash refunds have a limit; higher amounts are processed via card.

Q9. How to Claim VAT Refund for a Company in UAE?

Companies can claim refunds on input VAT that exceeds their output VAT.

Steps:

- Ensure that VAT return filing is complete and accurate.

- Log in to the FTA portal.

- Submit a VAT Refund Form 311.

- Provide IBAN letters, bank details, and supporting invoices.

- Wait for FTA review and approval.

If the FTA requests clarification, respond promptly to avoid delays.

Q10. How to Claim VAT Refund in the UAE for Imports?

If businesses pay VAT at customs for imports, they can reclaim it through their VAT return.

Steps:

- Confirm that your Import Declaration is linked to your TRN.

- Check the VAT amount in Box 6 of your VAT return (Import VAT).

- Report the same VAT amount as recoverable input tax in Box 10.

- Submit a return; the import VAT is automatically refunded or adjusted against dues.

If the TRN is not linked to customs, you must correct it through FTA before claiming.

Q11. How long do I have to claim my VAT refund in the UAE?

You have 90 days from the date of purchase to validate your Tax-Free tag and start the refund process.

Q12. What happens if I don’t validate my Tax-Free tag within 90 days?

Your Tax-Free tag automatically expires, and you will no longer be eligible to claim a VAT refund for that purchase.

Q13. Can you give an example of the 90-day validity period?

Yes. If your Tax-Free form was issued on January 1, it will remain valid until April 1. After this date, the refund cannot be processed.

Q14. Can I extend the 90-day VAT refund period?

No. 90 days are fixed and cannot be extended under any circumstances.

Q15. What if I leave the UAE before validating my Tax-Free tag?

If you fail to validate it at an official Tax-Free kiosk before departure, you lose eligibility for the refund, no exceptions.

Q16. Does the 90-day period apply to all purchases?

Yes, the rule applies to every eligible Tax-Free purchase, regardless of value or store.

Q17. How Much VAT Do Tourists Actually Get Back?

When claiming VAT refunds in the UAE, tourists don’t receive the full VAT amount; they get up to 87% of the tax they paid. A small processing fee of AED 4.80 is charged for every tax-free tag linked to a receipt. There’s also a limit on cash refunds, capped at AED 35,000.

Anything beyond that can still be refunded but only through cards or digital methods. Tourists can choose how they want to receive their refund, cash (within the limit), credit/debit card, or digital wallets like WeChat, offering flexibility based on what’s most convenient for them.