Calculating VAT in UAE might sound tricky, but with the right approach, it’s surprisingly simple. Understanding the process is essential for business owners trying to stay on top of their financial responsibilities. VAT, or Value Added Tax, is a tax on goods and services that’s added at each stage of production or distribution. The good news is that you don’t need to be a financial expert to calculate it.

In this guide, we’ll walk you through the basics of VAT in the UAE, showing you exactly how to calculate VAT in the UAE without any hassle. We’ll cover what VAT is, why it’s important, and the simple steps you can follow to ensure you’re calculating it correctly.

Along the way, we’ll also provide practical examples to make the process even clearer. By the end of this guide, you’ll feel confident in your ability to manage VAT calculations, whether for your business or personal understanding.

What is VAT in UAE?

VAT (Value Added Tax) in the UAE is a consumption tax levied on most goods and services. Introduced on January 1, 2018, at a standard rate of 5%, VAT is applied at each stage of the supply chain where value is added. Businesses collect VAT on behalf of the government, and consumers ultimately bear the cost when purchasing goods or services.

The tax is part of the UAE government’s efforts to diversify revenue sources beyond oil. Under specific conditions, some goods and services, such as education and healthcare, may be exempt or zero-rated.

How to Calculate VAT in UAE

Businesses registered for VAT in the UAE must maintain accurate records of their income and VAT payments. VAT is charged at a rate of 5% on the invoice value for all customers of registered businesses. Additionally, businesses pay 5% VAT on the goods and services they purchase from suppliers.

To manage VAT efficiently, it’s important to understand the difference between the VAT collected on sales (Output VAT) and the VAT paid on purchases (Input VAT). The VAT owed to the tax authorities or eligible for a refund is determined by the following formula:

VAT=Output VAT−Input VAT

- Output VAT: The VAT collected on sales and services.

- Input VAT: The VAT paid on raw materials and purchases.

To use this formula, calculate the total Output VAT collected during the taxable period and the total Input VAT paid. Subtract the Input VAT from the Output VAT to determine your VAT liability.

- If Output VAT exceeds Input VAT, the difference is the amount you owe to the tax authorities.

- If Input VAT exceeds Output VAT, you are entitled to a refund, and no VAT is due.

Understanding this process is essential for managing VAT effectively and ensuring compliance with UAE tax regulations.

VAT Calculation Formula

There are two methods for calculating VAT in the UAE, depending on whether VAT is included in or excluded from the sale price. Here’s how to apply each method:

Adding VAT to the Sale Price

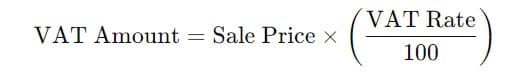

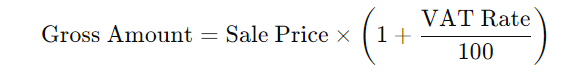

Use this method when VAT is not included in the sale price. To calculate the VAT amount and the total price, including VAT, use the following formulas:

VAT Amount

Gross Amount (Including VAT)

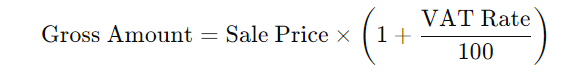

Excluding VAT from the Sale Price

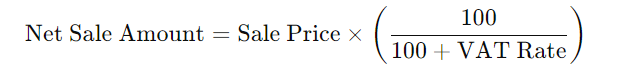

Use this method when VAT is included in the sale price. To find the VAT amount and the net sale amount (excluding VAT), use these formulas:

VAT Amount:

Net Sale Amount (Excluding VAT):

VAT Calculation Example

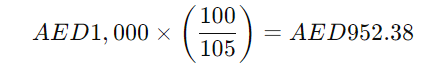

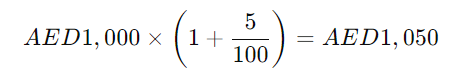

Let’s calculate VAT using an example with a sale amount of AED 1,000 and a VAT rate of 5%.

When VAT is Part of the Sale Price:

VAT Amount:

Net Sale Amount (Excluding VAT):

When VAT is Excluded from the Sale Price:

VAT Amount:

Gross Amount (Including VAT):

These methods will help you accurately calculate VAT based on whether it is included in or excluded from the sale price.

How Business Owners Can Calculate VAT in the UAE

In the UAE, the VAT rate is set at 5%, one of the lowest globally. Instead of the government collecting VAT directly, businesses are responsible for charging their customers and remitting the collected VAT to the authorities.

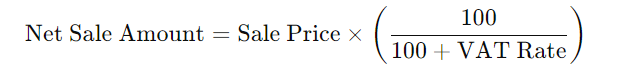

To calculate VAT, use the following formula:

VAT Payable = Output Tax – Input Tax

Output Tax

Output tax is the VAT collected by a seller from customers on the selling price of the final product or service. In the UAE, VAT is 5%. For example, if the selling price of a product or service is AED 200, the output tax (VAT collected) would be:

Output Tax=200×5%= AED10.00

Output tax is also known as VAT Collected.

Input Tax

Input tax is the VAT a business pays on the cost price of goods or services used to produce a final product. The standard VAT rate is 5% in the UAE. For example, if the cost price of goods or services is AED 100, the input tax (VAT paid) would be:

Input Tax=100×5%=AED5.00

Input tax is also referred to as VAT Credit or Recoverable VAT.

VAT Payable

To determine the VAT payable to the government, subtract the input tax from the output tax:

VAT Payable=Output Tax−Input Tax

For example, if your output tax is AED 10.00 and your input tax is AED 5.00, the VAT payable would be:

VAT Payable=10.00−5.00=AED5.00

All businesses must collect VAT on sales (output tax) and recover VAT on purchases (input tax). The difference between the two amounts must be paid to the government.

How to Register for VAT in the UAE

In the UAE, VAT registration depends on your annual revenue:

- Mandatory Registration: If your business makes more than AED 375,000 annually, you must register for VAT.

- Optional Registration: If your annual revenue is between AED 187,500 and AED 375,000, registration is optional.

- Exempt from Registration: If your annual revenue is below AED 187,500, you do not need to register for VAT.

Steps to Register for VAT

- Visit the FTA Website: Go to the Federal Tax Authority (FTA) website.

- Create an e-Services Account: Sign up for an e-Services account to activate your profile.

- Access Your Dashboard: Log in to your e-Services account.

- Register for VAT: Click “Add New Taxable Person” and follow the simple process to complete your VAT registration.

By following these steps, you can easily register your business for VAT in the UAE.

Simplify VAT Calculation with Shuraa Tax

Calculating VAT in the UAE can seem complex, but with Shuraa Tax, it becomes straightforward. Our team simplifies the VAT process, guiding you through each step—from understanding VAT basics to calculating and managing VAT payments.

With practical examples and clear instructions, Shuraa Tax ensures you handle VAT efficiently and comply with UAE regulations. For personalized assistance, contact us at +971 50 891 2062 or email info@shuraatax.com.

FAQs

Q1. How is VAT calculated in the UAE?

To calculate VAT in the UAE, you need to apply the 5% VAT rate to the sale price. For example, if the price of a product or service is AED 100, the VAT amount would be AED 5 (calculated as AED 100 x 0.05). Thus, the total amount payable would-be AED 105 (AED 100 + AED 5 VAT).

Q2. What is the VAT rate in the UAE?

The UAE’s standard VAT rate is 5%. However, certain goods and services are classified as exempt or zero-rated, meaning no VAT is applied to them. Exempt supplies include specific healthcare and educational services, while zero-rated supplies may include certain international goods and services.

Q3. How do you calculate 5% VAT in the UAE?

To calculate 5% VAT, multiply the sale price by 0.05. For example, if the sale price is AED 200, the VAT is AED 10 (AED 200 x 0.05). Add this to the sale price to get the total amount payable, AED 210.

Q4. How to calculate VAT on AED 100?

For a product priced at AED 100, the 5% VAT would be AED 100 × 5% = AED 5.00. Thus, the Input VAT is AED 5.00.

Q5. How do you find the price before VAT from a gross amount?

To remove VAT from a price, follow these steps: First, divide the gross amount by 1 plus the VAT percentage (expressed as a decimal). Then, subtract the resulting value from the gross amount. Finally, multiply by -1 and round to the nearest value.